China has embarked on the world’s first full-fledged digital currency experiment. According to the April 14 issue of the South China Morning Post, the People’s Bank of China has launched a test trial of the digital yuan, or its digital currency, in four cities.(1) There are several countries studying the introduction of digital currency, including Sweden, but China is the first country to begin a full-fledged implementation.

With the launch of the digital yuan, the world has begun to pay attention to the potential for the yuan to become a key currency. The key currency so far is the US dollar. The US dollar is also used most often in international money transactions and in the composition of central banks’ foreign reserves. Thanks to the dollar being the key currency, the United States has been able to exert great power in the international community. If the Chinese yuan loses its key currency position, the US position itself could be shaken significantly. That’s why Washington officials are paying keen attention to China’s launch of the digital yuan.

However, the fact that the US dollar is the key currency is very uncomfortable for the Chinese. More than 80% of the country’s import and export transactions must be settled in dollars and the international payment system is dominated by the United States. China could be subject to economic sanctions at any time if the United States puts their mind to it. The Communist Party wants the Chinese economy free from the influence of the dollar.

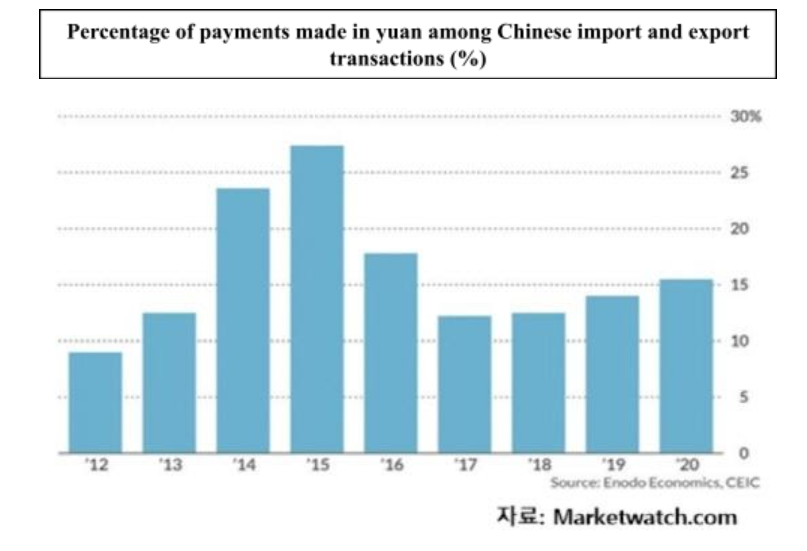

So, China has been working hard to internationalize the yuan since the 2008 financial crisis and to make it a key currency. But the results are poor. This graph shows the percentage of yuan used in China’s own import and export trade. In 2020, 15% was used while 85% of the deal was made in dollars and in other currencies. Furthermore, that is much less than the 27% in 2015.(2)

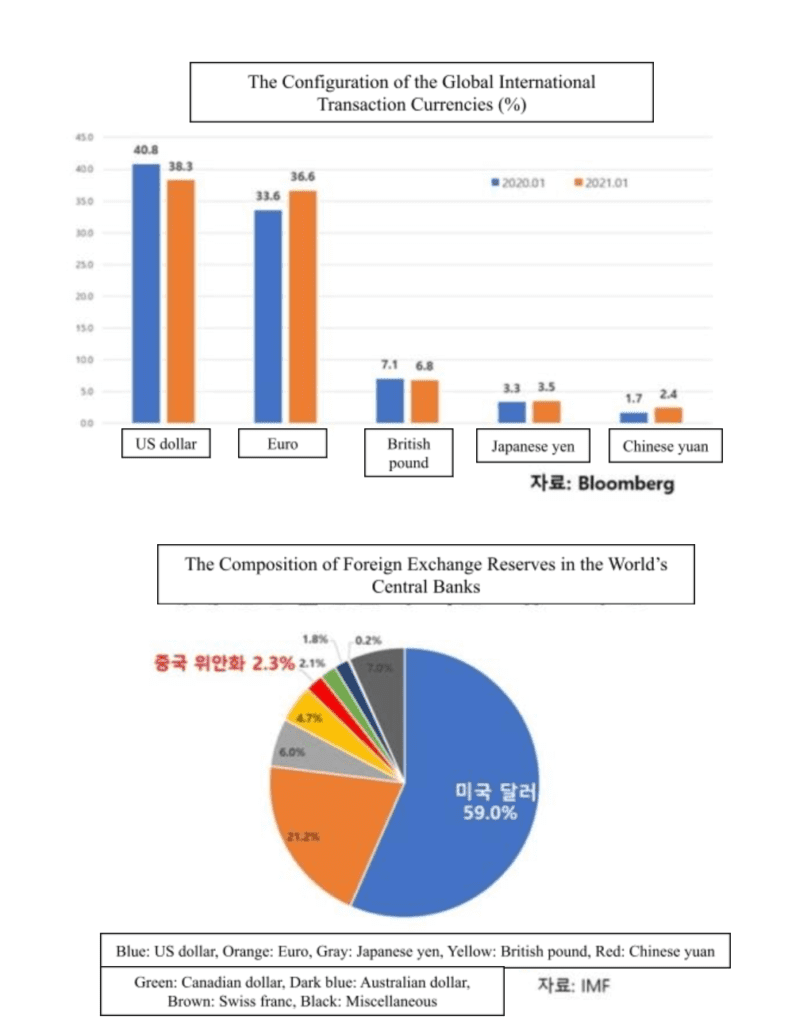

The share of international transactions around the world is even more dismal. In January 2021, the proportion of yuan settlements in global international transactions is 2.4%. It has increased than the 1.6% from last year, but it’s no match for the 38% status of the US dollar.(3)

The foreign exchange reserves in central banks also reveal the feebleness of the yuan.(4) As of the fourth quarter of 2020, 59% of the world’s central banks’ total foreign exchange reserves are US dollars. The Chinese yuan ranks fifth at 2.3% behind the euro, the Japanese yen and the British pound.

It’s understandable if China takes offense. As of 2018, China’s trade volume was $4.6 trillion, accounting for 12.4% of the world’s total trade. This is number one in the world. The United States is $4.3 trillion or 11.5%, which is less than China. Based on the proportion of the international transactions alone, the Chinese yuan is more suitable as a key currency than the US dollar. However, the real status of the yuan is meager.

Why did the yuan fail to become the key currency? The biggest problem lies in the inability to trust the Chinese Communist Party. For a country’s currency to rise as the international key currency, the people around the world must be able to depend on the money with confidence. For that, the issuance and distribution of the money must be managed transparently, and the exchange must happen freely. The Chinese currency, the yuan, does not meet those requirements. There is no way from the outside to know how the money is managed and the currency exchange is severely restricted. Remittances are said to be free up to $50,000, but even that is being restricted. It would make anyone feel uneasy to keep such money as an asset.

That’s why the yuan’s status in international trade does not rise significantly despite its strength in terms of exchanges rates post-COVID-19. Of course, they say it’s a little better, but it’s like a typhoon in a teacup.

For the digital yuan to rise to the status of the international key currency, it must reduce the vulnerability of the existing yuan, namely the opacity of the currency management and the anxiety of investors subject to heavy capital control. Will the Chinese government be able to do that? I think it’s very unlikely. It is rather likely to be the other way around. People around the world will be even more reluctant to possess the digital yuan than the conventional yuan. Because the issue of infringement on privacy will be added onto the existing vulnerabilities. To trade the digital yuan, you need to download the e-wallet from the People’s Bank. If the authorities put their minds to it, they can always look at the transaction details. Who would want to make transactions with that kind of money?

In terms of privacy, Chinese digital yuan is nothing like cryptocurrency. It may differ depending on how it was developed, but at least cryptocurrency like Bitcoin guarantees complete anonymity. On the other hand, the digital currency of the People’s Bank of China is unlikely to guarantee anonymity. Of course, the Chinese government says it will guarantee privacy, but not many people will believe that. Unless privacy is guaranteed, chances of the digital yuan being accepted as the international key currency are slim. Paper currency would be better. It’s possible that the Chinese would also like to possess US dollars, not the Chinese digital currency, if they could.

I repeat, if a country’s currency is to be accepted as a key currency, people in other countries must be able to hold the money. The yuan, even if converted into digital currency, is unlikely to become the international key currency. Especially if the CCP continues to manage its currency this way.

The United States is also preparing to introduce the digital dollar. Remarks made by Jerome Powell, the Chair of the Federal Reserve, at a House hearing on March 23 hinted at that direction.(5)

“We cannot introduce a system that doesn’t guarantee privacy like China does. We’re taking the time to approach these issues carefully and in detail.”

The US digital dollar is also not expected to guarantee complete anonymity because of the possibility that it will be used to fund terrorism or crime. Existing laws on financial privacy are likely to apply against the digital dollar. In any case, it would be more reassuring than China’s digital yuan. Even if the dollar depreciates further due to the overuse of money, people still expect to accept the US digital dollar as a key currency, not China.

South Korea is also expected to embark on a trial use of the digital won starting in June, but it doesn’t make much difference in our daily lives. Even now, we are practically using e-money. Credit cards, electronic payment systems and such are real e-money. What makes digital currency and electronic money different from the conventional electronic payment methods is the fact that the administrator is the government, not the private sector.

That is why we need to keep a close eye on this digital currency. If left unchecked, politicians and civil servants can get a glimpse of my assets in real time. We must demand technical, legal, and political devices to prevent us from doing so. We must keep our eyes open so that the new electronic currency does not become a public watchdog like with China’s digital yuan.

Kim Jung-ho, guest columnist (Adjunct Professor at Sogang University’s Graduate School of Economics)